- Home

- > Blog

Building a Savings Habit

In our blog ‘Now You have Time, Take Time to Make Smart Money Moves’ one of the actions we discussed was to Set a Savings Goal. Many of us want to start saving but just can’t get started. We are going to walk you through some simple steps to help you begin.

Start with a Review

Knowing your disposable income is the first step to creating an achievable and sustainable savings habit. You will need to calculate how much you have leftover from your income once your expenses are paid to get started on this, you can download our simple and easy to use Budgeting Sheet below.

Set a Savings Goal

Setting a savings goal gives you something to work towards. We all have different things in life that we are reaching for – holidays, college, moving house, a new car, or saving for a rainy day. When you have decided your next big savings goal, then work out how much you need to save each week or each month to get you to the finishing line. It is better to give yourself a realistic amount and a realistic time frame, otherwise we can set ourselves up to miss target and that can be enough to stop the good habit of savings.

How Much is Enough?

Do you budget weekly or monthly? It depends on your own preference and also on the frequency of your income and outgoings.

Once you have figured out your weekly or monthly disposable income, this will show you how much you can save each week or each month. It is important to have a realistic expectation of how much you have the ability to save each week or each month in order for your savings to be manageable and for your saving habit to be successful.

Set yourself a “Goldilocks” amount to save – Not Too Little, Not Too Much – Just Right!

The Golden Rule of Smart Money Management is 50/30/20, with 50% of your income spent on essentials, 30% on wants and 20% set aside for savings. Starting is the hardest part of forming a habit and remember out of little acorns, large oaks grow, starting is the important thing. Saving €10 a week gives you €520 in twelve months, €50 would see €2600 saved!

Set up a Savings Account

A good idea is to set up an account, separate to your current account, just for your savings. This way you are less likely to dip in, removing the temptation. Setting up a standing order is a great discipline, it comes out of your current account on the same day each month, you set the amount and then technology does the rest.

You can set up a standing order to put your savings into your Credit Union account. Your BIC/IBAN codes can be found on any transaction receipt from Dundalk Credit Union.

Remember we should save from the top (when you get paid), not from the bottom when excuses get in the way!

If you started this week, here’s what you would have in 6 months (26 weeks) & in 1 year (52 weeks)

Start Saving

The final step is start saving.

Your savings goal will help you to stay on track and you can register here for CU Online to watch your savings grow.

Savings is Child’s Play Too!

As a family, it is great idea to start the habit of saving with your children or grandchildren. Our members often join as babies in the pram, we see them grow to start school, college, buy their first car, buy their first home. At every age and at every stage, we are here for you.

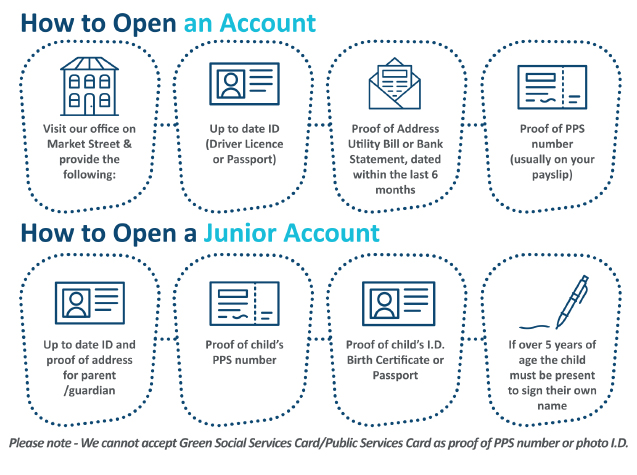

To become a Member of Dundalk Credit Union: